Optical Satellite Communication Market by Type (Satellite-to-Satellite, Ground-to-Satellite Communication), Component (Transmitter, Receivers, Amplifiers, Transponders, Antenna, Converter), Application, Laser Type and Region - Global Forecast to 2028

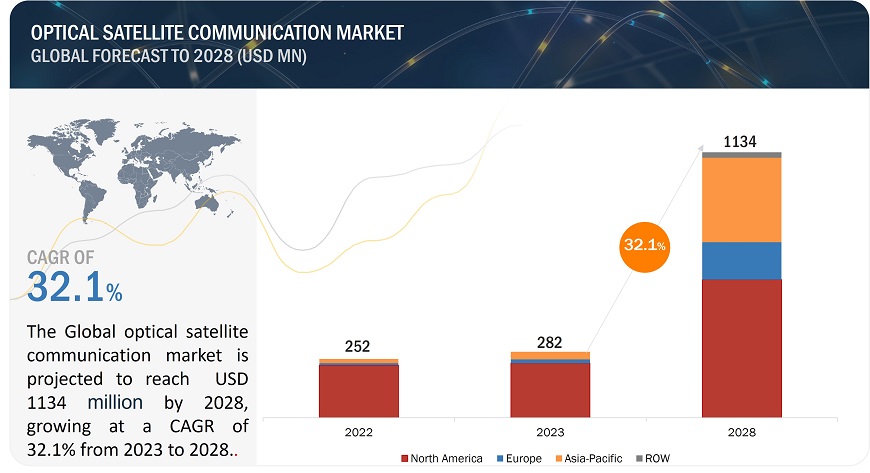

The Optical Satellite Communication Market is projected to grow from USD 282 Million in 2023 to USD 1134 Million by 2028, growing at a CAGR of 32.1 % from 2023 to 2028. The Optical Satellite Communication Industry can be linked to the rising deployment of low earth orbit (LEO) satellites and satellite constellations designed for communication purposes. The surge in demand for optical satellite communication can be attributed to several key drivers, including the escalating requirement for dependable high-speed communication networks in remote regions, the growth of the commercial space industry, and and the increasingly widespread integration of satellite technology within military and governmental applications.

The trend toward shrinking satellites, such as CubeSats and SmallSats, opens possibilities for incorporating optical communication technologies into smaller and more cost-effective satellite platforms. Optical communication can help to bridge communication gaps in remote and underserved areas by enabling quick and dependable data transmission in places with insufficient terrestrial infrastructure. Due to the paucity of RF spectrum for communication, there has been increased interest in investigating optical communication options. Regulatory considerations and spectrum constraints in RF communication drive the pursuit of optical solutions.

Optical Satellite Communication Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Optical satellite communication Market Dynamics

Driver: Space Exploration and Scientific Research

Optical satellite communication has the potential to revolutionize space exploration and scientific research by facilitating high-bandwidth data transmission between space probes, rovers, and Earth-based research centers. This technology can enhance the efficiency and speed of data transfer in space missions.

Optical satellite communication is a game-changer for the space exploration and scientific research industries, offering high-bandwidth data transmission between space probes, rovers, and research centers on Earth. With traditional radio-frequency methods limiting data transfer rates, optical communication's use of laser beams ensures faster, more efficient, and more secure data links.

For space missions, this technology enables real-time or near-real-time transmission of critical data collected from instruments onboard spacecraft, enhancing mission efficiency and decision-making processes. As space missions grow in complexity, optical links can handle the surge in data volume, optimizing overall mission performance. Additionally, direct communication between spacecraft and research centers eliminates the need for intermediate relays, reducing signal latency and improving responsiveness.

Beyond space exploration, optical satellite communication benefits scientific research on Earth, allowing satellite-based telescopes and climate studies to transmit large datasets quickly to researchers on the ground. This technology has the potential to revolutionize how data is gathered, analyzed, and utilized in both space and terrestrial scientific endeavors, ushering in a new era of efficiency and productivity for these industries.

Restraints: Government regulations and policies restrict the deployment of optical satellite communication systems in certain regions

Government regulations and policies vary from country to country but commonly include spectrum allocation, power limits, encryption requirements, and export controls. Governments allocate specific portions of the electromagnetic spectrum for OSC systems to avoid interference with other radio transmissions. Power limits are set to mitigate potential interference issues caused by high-power transmission in OSC systems. To protect sensitive data transmission, governments often mandate encryption for OSC systems. Additionally, due to potential military applications, export controls are imposed to regulate the international trade of OSC technology.

Alongside government regulations, various private sector organizations have established standards for OSC systems to ensure interoperability and performance consistency. Notable organizations include the International Telecommunication Union (ITU), which sets international telecommunications standards. The Optical Interworking Forum (OIF) is dedicated to optical communications standards, and the Satellite Industry Association (SIA) represents the satellite industry and developing related standards.

Opportunities: Towering adoption of cloud-based services by different industries

Various industries are now using cloud-based services to provide improved services to their customers. Moreover, cloud-based services using advanced SATCOM equipment are being used extensively by first responders, emergency services agencies, law enforcement agencies, and military forces, among others. The increasing adoption of cloud-based services for such applications is expected to provide growth opportunities for the SATCOM equipment market during the forecast period. Cloud computing is a significant cost-efficient IT resource as the cost of on-demand IT services is based on the actual use of those services by consumers. Cloud-based services are also used by companies when their data centers are insufficient to handle all their IT requirements. These services can rapidly increase the IT capabilities of companies without requiring large investments for new data centers, as cloud pricing is inversely proportional to the number of users sharing a cloud infrastructure.

Challenges: Atmosphere Interference.

Earth's atmosphere poses another significant challenge for optical communications. Clouds and mist can disrupt the laser signals, affecting the reliability of the communication link. To overcome this hurdle, the deployment of multiple ground stations equipped with telescopes capable of receiving infrared waves is being explored. With a network of ground stations, the system gains flexibility, redirecting data transmission to operational stations during adverse weather conditions. The SCaN is investigating various approaches, such as Delay/Disruption Tolerant Networking and satellite arrays, to mitigate challenges arising from atmospheric disturbances.

Based on the type, the Satellite-to-satellite communication segment is estimated to lead the Optical satellite communication market from 2023 to 2028.

Based on the platform, the airborne OPTICAL SATELLITE COMMUNICATION segment is estimated to lead the Optical satellite communication market from 2023 to 2028. This is because North American and European countries have been focusing on using Satellite-to-satellite (STS) in Optical satellite communication prominently. STS platforms achieve data rates that are much higher than ground-to-satellite (GTS) platforms. This is because STS platforms do not have to contend with the atmosphere, which attenuates and scatter laser beams.

Based on the components, Transponders dominate the market & are projected to witness the largest share in 2023

Transponders dominate the optical satellite communication segments area since they are required for data transmission and reception between satellites and ground stations. Transponders amplify and modulate radio signals, which is required for satellite communications. In addition, they turn digital data into radio waves and vice versa. Transponders are used in optical satellite communication to transmit and receive laser beams. Laser beams are utilized because they can carry more data and travel quicker than radio frequencies. Transponders can also encrypt and decrypt data, which is critical for security.

Based on the application, the government & defense segment dominates the market & is projected to witness the largest share in 2023

In space missions, including scientific investigation, exploration, and data collection, optical communication is used. High-speed data transmission is critical for returning vast amounts of scientific data to Earth. By improving communication between satellites and ground stations, optical communication helps to improve navigation and positioning systems.

Based on laser type, GaAs-based lasers seem to dominate this segment and is estimated to account for the larger share of the Optical satellite communication market from 2023 to 2028

Based on laser type, GaAs-based lasers seem to dominate this segment. GaAs-based lasers can be designed to emit light at optimal wavelengths for optical communication in space. These wavelengths are selected to minimize atmospheric absorption and scattering, resulting in efficient and consistent transmission over the Earth's atmosphere. GaAs-based lasers can function effectively in a wide variety of temperatures, including those encountered in space. Their capacity to operate dependably in a wide range of temperatures is critical for space missions.

The Asia Pacific market is projected to grow at the highest CAGR from 2023 to 2028 in the Optical satellite communication market

Based on region, the Asia Pacific market is projected to grow at the highest CAGR from 2023 to 2028 in the Optical satellite communication market. The Asia-Pacific area, which includes China, India, Japan, and numerous Southeast Asian countries, has seen substantial economic growth and development. Increased investment in space technology, research, and infrastructure, including satellite communication systems, has resulted from this expansion. Many Asian countries have increased their space operations, including satellite launches and space exploration missions. Because of this increased presence in space, there is a greater demand for efficient and fast communication technologies, making optical satellite communication an appealing alternative. Governments in the Asia-Pacific region have launched projects to improve their space capabilities. These programs frequently include investments in sophisticated communication technology research, development, and implementation, such as optical satellite communication. Several countries in the region have established or expanded their space agencies, encouraging cooperation. Additionally, the involvement of private sector companies has introduced competition and innovation in the space and communication sectors.

Optical Satellite Communication Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Optical Satellite Communication Industry Companies: Top Key Market Players

The Optical Satellite Communication Companies is dominated by a few globally established players such as Ball Corporation (US), Mynaric AG (Switzerland), Bridge Comm Systems (US), SpaceMicro (US), Tesat Spacecom GMBH (Germany). among others, are the key manufacturers that secured Optical satellite communication contracts in the last few years. The primary focus was given to the contracts and new product development due to the changing requirements of commercial, homeland security, and defense & space users across the world.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Estimated Market Size

|

USD 282 Million in 2023

|

|

Projected Market Size

|

USD 1134 Million by 2028

|

|

Growth Rate

|

CAGR of 32.1 %

|

|

Market size available for years |

2020–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By type, by components, by laser type, by application, and by region |

|

Geographies covered |

North America, Europe, Asia Pacific, Rest of the world |

|

Companies covered |

Ball Corporation (US), Mynaric AG (Switzerland), Bridge Comm Systems (US), Space Micro Inc. (US), and Tesat Spacecom GMBH (Germany)are some of the major players in the Optical satellite communication market. (13 Companies) |

Optical Satellite Communication Market Highlights

|

Segment |

Subsegment |

|

By Type |

|

|

By Components |

|

|

By Application |

|

|

By Laser type |

|

|

By Region |

|

Recent Developments

- In June 2023, Mynaric AG was selected by Raytheon Technologies to supply optical communications terminals for the Space Development Agency (SDA) Tranche 1 Tracking Layer program. The program aims to detect, identify, and track hypersonic weapons and advanced missiles from their earliest stages of launch through interception using a low-Earth orbit constellation of networked satellites. Mynaric will supply 21 CONDOR Mk3 terminals to Raytheon for the program, and each satellite will feature three optical communications terminals, as well as a Ka-band, multi-beam payload for communications.

- In May 2023, Sidus Space, a Space, and Defense-as-a-Service satellite company, has chosen ATLAS Space Operations to expand its ground station services for the LizzieSat™ constellation. This partnership will increase global coverage and data speed, benefiting the Space and Defense-as-a-Service solutions offered by Sidus Space. The expanded ground site network is expected to reduce latency and enhance data transfer capabilities.

- In February 2022, Voyager Space Inc. and Space Micro, Inc. got a contract from the Space Development Agency (SDA) for advanced one-to-many optical communications using Managed Optical Communication Array (MOCA) technology to support Low Earth Orbit (LEO) constellations.

- In June 2022, the deal was signed between Kepler's Aether satellites & Spire Global. Optical communication terminals will be installed on Kepler's Aether satellites, enabling data transfer at up to 2.5 Gbps for end users, including customers like Spire Global and the European Space Agency (ESA). Tesat-Spacecom is known for providing optical communication terminals to various U.S. spacecraft primes in support of government programs such as the Space Development Agency's (SDA) Transport Layer and Tracking Layer, as well as DARPA's Blackjack program.

Frequently Asked Questions (FAQ):

Which are the major companies in the optical satellite communication market? What are their major strategies to strengthen their market presence?

Some of the key players in the optical satellite communication market are Ball Corporation (US), Mynaric AG (Switzerland), Bridge Comm Systems (US), SpaceMicro (US), Tesat Spacecom GMBH (Germany), among others are the key manufacturers that secured Optical satellite communication contracts in the last few years. Contracts were the key strategies these companies adopted to strengthen their Optical satellite communication market presence.

What are the drivers and opportunities for the Optical satellite communication market?

Optical satellite communication is a game-changer for the space exploration and scientific research industries, offering high-bandwidth data transmission between space probes, rovers, and research centers on Earth. With traditional radio-frequency methods limiting data transfer rates, optical communication's use of laser beams ensures faster, more efficient, and more secure data links.

For space missions, this technology enables real-time or near-real-time transmission of critical data collected from instruments onboard spacecraft, enhancing mission efficiency and decision-making processes. As space missions grow in complexity, optical links can handle the surge in data volume, optimizing overall mission performance. Additionally, direct communication between spacecraft and research centers eliminates the need for intermediate relays, reducing signal latency and improving responsiveness.

Which region is expected to grow most in Optical satellite communication market in the next five years?

The market in Asia Pacific is projected to grow at the highest CAGR from 2023 to 2028, showcasing strong demand for Optical satellite communication in the region. One key factor driving the Asia Pacific market is the rising demand for launch & early orbit support, TT&C services, and data handling & processing services.

Which type of Optical satellite communication will significantly lead in the coming years?

A satellite-to-satellite segment of the Optical satellite communication market is projected to witness the highest CAGR due to the increasing need for the fastest, most secure, and most comprehensive coverage of international and intercontinental data networks for enterprise systems between 2023 to 2028.

Which are the key technology trends prevailing in the Optical satellite communication market?

Optical communication is increasingly being utilized to construct high-speed links between satellites in a constellation, hence improving data sharing and coordination. Laser technology is progressing, allowing for faster data rates, longer communication distances, and improved signal quality in optical communication systems. Optical communication is being investigated for far space missions, particularly interplanetary missions, where its higher data rates and reduced latency outperform typical RF communication. Space agencies, private firms, and research organizations are collaborating to drive the development and implementation of optical communication technologies.

To speak to our analyst for a

discussion on the above findings, click Speak to Analyst

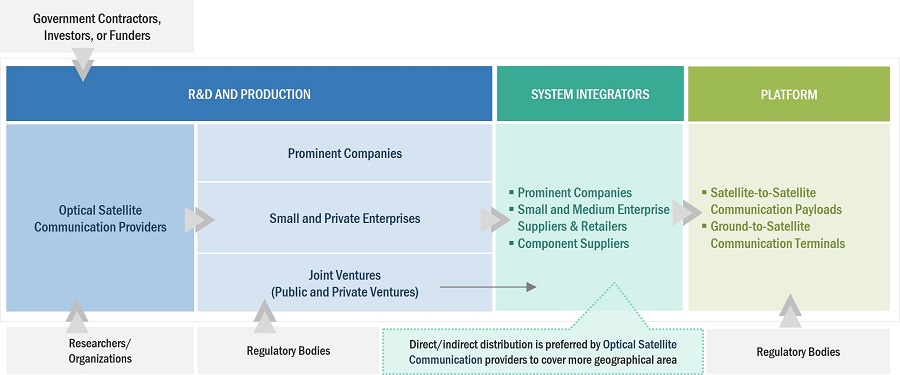

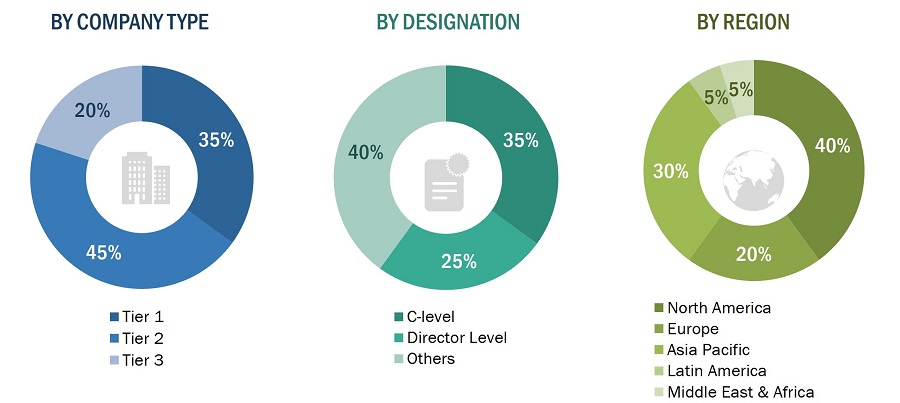

The study involved four major activities in estimating the current size of the Optical satellite communication Market. Exhaustive secondary research was done to collect information on the Optical satellite communication market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. After that, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the Optical satellite communication Market.

Secondary Research

The market ranking of companies was determined using secondary data made available through paid and unpaid sources and by analyzing the product portfolios of major companies. These companies the performance on the basis of the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred to for this research study included financial statements of companies offering Optical Satellite Communication hardware and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the Optical Satellite Communication market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information regarding the Optical Satellite Communication market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, ROW which includes the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

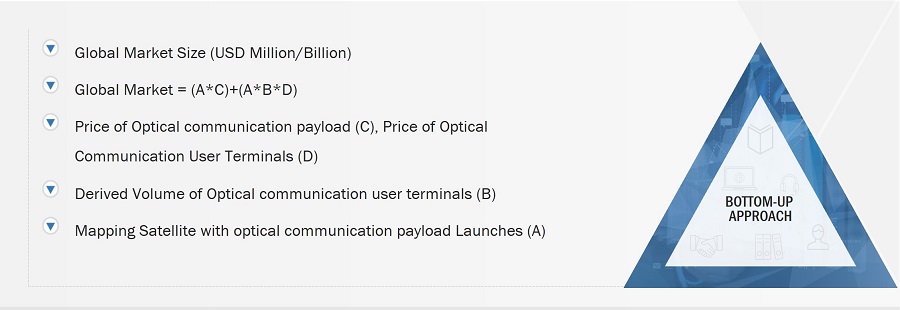

Market Size Estimation

The market sizing of the market was undertaken from the demand side. The market was upsized at a regional level based on procurements and modernizations in the land fixed, land mobile, airborne, naval, and portable platforms. Such procurements provide information on each platform's demand aspects of Optical satellite communication products. For each platform, all possible application areas where Optical satellite communication is integrated or installed were mapped.

Note: An analysis of technological, military funding, year-on-year launches, and operational cost were carried out to arrive at the CAGR and understand the market dynamics of all countries in the report. The market share for all type, component, application, and laser type was based on the recent and upcoming launches of Optical satellite communication products in every country from 2020 to 2028.

Optical satellite communication Market Size: Bottom-up Approach

Optical satellite communication Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

The following figure indicates the market breakdown structure and the data triangulation procedure that was implemented in the market engineering process to make this report on the Optical Satellite Communication market.

Market Definition

The optical satellite communication market refers to the sector that deals with developing, manufacturing, and deploying satellite communication systems that utilize optical technology for data transmission. Optical satellite communication (free-space optical communication (FSO) involves sending data through laser beams or infrared signals instead of traditional radio frequency (RF) signals used in most satellite communication systems. This technology offers high data transmission rates, low latency, and increased security for sensitive data transfer. With a growing demand for global connectivity and data-intensive applications, optical communication presents a potential solution to meet these needs. Despite challenges related to atmospheric conditions, advancements in technology are continuously improving its viability.

Optical Satellite communication consists of Satellite-To-Satellite Communication Payloads: Satellite-to-satellite communication payload encompasses inter-satellite links (ISLs) deployed within satellites to facilitate optical communication between these spaceborne platforms.

Ground -To- Satellite- Communication Terminals: Ground-to-satellite communication terminals encompass optical ground terminals, including optical ground stations and optical terminals, employed for laser communication between the terrestrial infrastructure and satellite systems.

Market Stakeholders

- Manufacturers of Optical satellite

- System Integrators

- Original Equipment Manufacturers (OEM)

- Service Providers

- Research Organizations

- Investors and Venture Capitalists

- Ministries of Defense

Report Objectives

- To define, describe, and forecast the size of the Optical satellite communication market based on type, component, application, laser type, and region.

- To indicate the size of the various segments of the Optical satellite communication market based on five regions—North America, Europe, Asia Pacific, Rest of the world—along with key countries in each of these regions.

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market.

- To determine industry trends, market trends, and technology trends prevailing in the market

- To analyze micro markets concerning individual technological trends, prospects, and their contribution to the overall market

- To provide a detailed competitive landscape of the market and analyze competitive growth strategies such as product launches and developments, contracts, partnerships, agreements, and collaborations adopted by key players in the market.

- To identify the detailed financial positions, product portfolios, and key developments of leading companies in the market

- To strategically profile key market players and comprehensively analyze their market rank analysis and core competencies.

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Optical satellite communication Market

- Profiling of other market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Optical satellite communication Market.

Growth opportunities and latent adjacency in Optical Satellite Communication Market